If only the suckers could support a different reality tv clown.

Jerry Dean McLain first bet on former president Donald Trump’s Truth Social two years ago, buying into the Trump company’s planned merger partner, Digital World Acquisition, at $90 a share. Over time, as the price changed, he kept buying, amassing hundreds of shares for $25,000 — pretty much his “whole nest egg,” he said.

That nest egg has lost about half its value in the past two weeks as Trump Media & Technology Group’s share price dropped from $66 after its public debut last month to $32 on Friday. But McLain, 71, who owns a tree-removal service outside Oklahoma City, said he’s not worried. If anything, he wants to buy more. “I know good and well it’s in Trump’s hands, and he’s got plans,” he said. “I have no doubt it’s going to explode sometime.”

For shareholders like McLain, investing in Truth Social is less a business calculation than a statement of faith in the former president and the business traded under his initials, DJT.

[…]

McLain [said] he believes the stock could “go to $1,000 a share, easy,” once the media stops writing so negatively about it and the company works through its growing pains. The company’s leaders, he said, are being “too silent right now” amid questions about the falling share price, but he suspects it’s because they’re working on something amazing and new.

McLain is an amateur trader — he invested only once before and “lost [his] butt” — and said he hasn’t talked to his family about his investment, saying, “You know how that is.” But he believes the Trump Media deal is a sign he is “supposed to invest,” he said. “This isn’t just another stock to me. … I feel like it was God Almighty that put it in my lap,” he said. “I’ve just got to hold on and let them do their job. If you go on emotion, you’ll get out of this thing the first time it goes down.”

Over time, as the price changed, he kept buying, amassing hundreds of shares for $25,000 — pretty much his “whole nest egg,” he said.

That nest egg has lost about half its value in the past two weeks as Trump Media & Technology Group’s share price dropped from $66 after its public debut last month to $32 on Friday. But McLain, 71, who owns a tree-removal service outside Oklahoma City, said he’s not worried. If anything, he wants to buy more. “I know good and well it’s in Trump’s hands, and he’s got plans,” he said. “I have no doubt it’s going to explode sometime.”

can you imagine working at this idiot’s company and watching the surplus value of your effort not only going into this guy’s pocket, but then seeing it vanish into that. like, if your boss buy’s a golden toilet or a fancy car, you can at least steal it. this is like a receipt for magic beans.

More importantly, this guy is a business owner, and his savings are only $25,000?

Not very good at it, huh?

any day now, trump will press the “revalue truth social stock” and “revalue iraqi dinar” buttons and I’ll become a trillionaire

The “work harder” crowd is also the play the lotto crowd. These people are the biggest rubes on the planet. I love it so much. Bet this guy took a PPP loan as well and spent it on Trump media stocks.

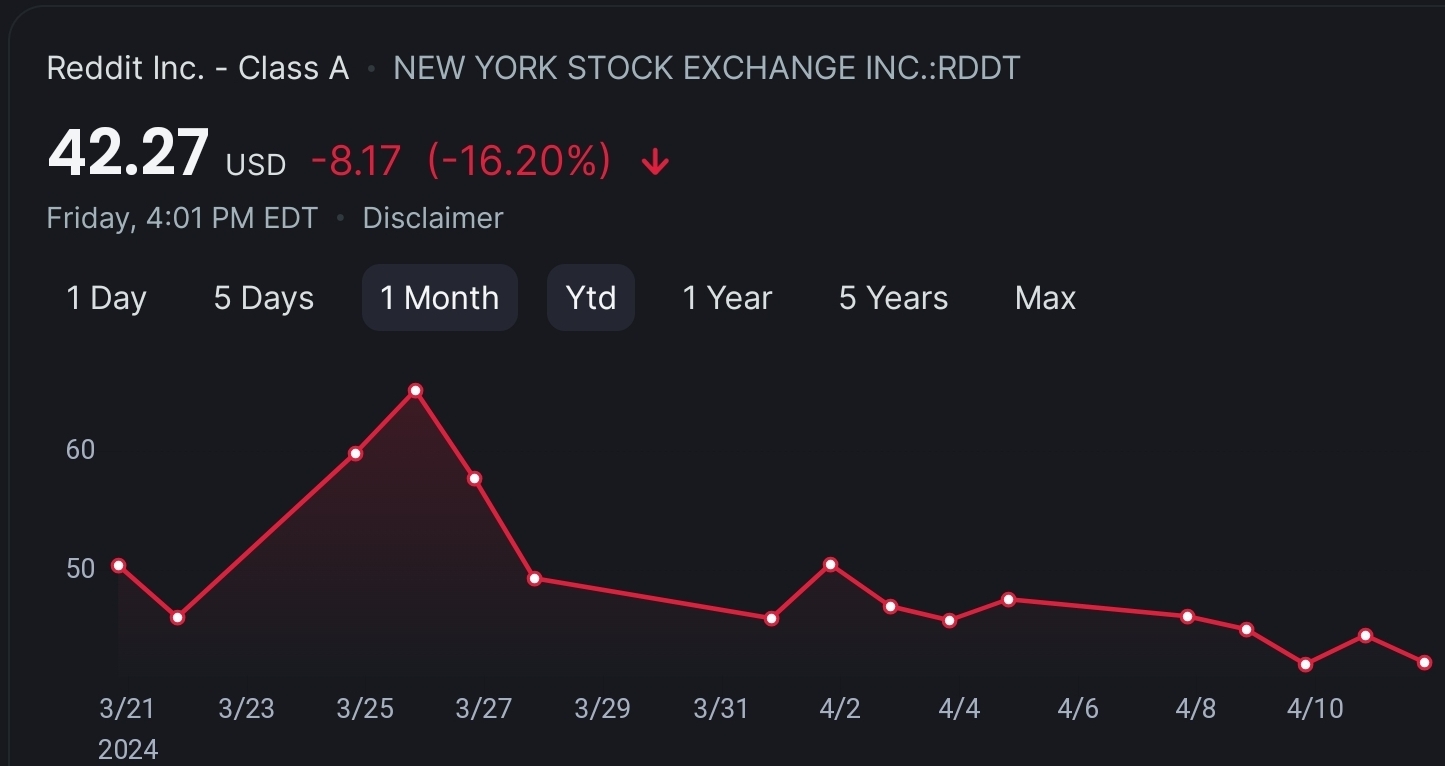

Meanwhile on

more like Beddshit

I like reddit at $10, it will just take a while to fall off the cliff and get there.

Trust the Process

he hasn’t talked to his family about his investment, saying, “You know how that is.”

I bet dudes wife threatened to leave him if he loses all their savings on some dumbass stock again.

“Because if Trump is known for one thing, it’s never having business fail. And NEVER screwing over the people who prop him up as soon as it’s convenient to do so. So yeah, I have faith, but really it’s just logic.”

“Because if Trump is known for one thing, it’s never having business fail. And NEVER screwing over the people who prop him up as soon as it’s convenient to do so. So yeah, I have faith, but really it’s just logic.”In evil bad country the most popular political movement also doubles as a pyramid scheme.

Isn’t it confirmed a UI layer over a mastodon implementation or something

I guess I shouldn’t be mad because I’m sure this pic was just staged and the chainsaw isn’t on, but it’s still bad because it sends the message that people cut down trees like this. Chainsaws are death machines, they really want to sever your limbs and kill you. At a minimum, you need a helmet, eye protection, gloves, and leggings that prevent you from sawing off your legs, and even then you really need more. This is like seeing a pic of someone riding a motorcycle with no helmet and wearing shorts and flip flops.

You can get hurt with a lot of tools but only a select few actually lust for blood like a chainsaw does

He doesn’t even have safety glasses! You’re gonna get high velocity sawdust and woodchips straight into your eyeballs like that, and that’s just normal operation without something catastrophic happening!

It’s weird that we’ve developed these millenarian cults around securities. Sure, DJT is gonna hit $1000 and Dogecoin is gonna hit $10 and GameStop is gonna hit $10k. Why not. Just HODL, the rapture will be any day now.

I guess this proves that there are more California ideology tech bros in this country than Trumpers, since the former were able to sustain Tesla’s stock price on hype alone for years before it started making cars, while the latter couldn’t keep the hype alive for Trump for one month.

outside of California they are often the same guy

I don’t understand stocks.

Could someone end up owing money if their stock purchase falls into negative value? Or would they only be out their purchase?

If you own stock, the worst case scenario is it just becomes worthless. It’s all the other stock market shit, the stuff that’s basically gambling or taking out loans, that can result in actually owing money.

no, if you buy a stock, the most you could lose is 100%.

you could only ‘go negative’ and owe money if you short a stock, or sell options, etc.

negative value

You’re thinking of shorting a stock. You sign a contract to sell a stock. And the most dangerous version of it is naked short selling where don’t even own the stock.

--

Ninja edit

ELI5: Short selling : explainlikeimfive

Top comment

This one usually takes a while to grasp, so bear with me, and read it two or three times.

Normally, when you buy an investment (stocks, bonds, etc.; but stocks for this example), you buy now, and hold on to them until they become more valuable. Then you sell and make money. This is going “long”. You want the price of the stock to increase.

Going “short” is the opposite. You want the price to fall so you can make money. So how does one do this?

First, you need an broker. You borrow stocks from the broker, let’s say 1000 shares of a company, at $1 dollar each. Note that you’re not spending any money here, you’re borrowing them. This is important. Now, you go and sell those shares to someone else, and get $1000. You COULD us this $1000 to pay back your broker, but why do that? Instead, you wait until the stock price drops, let’s say to $0.50 a share. Now, you can buy back 1000 shares for $500, and return those 1000 borrowed shares to your broker. You just made $500 by the stock of the company going down, and the broker (usually representing people who go “long”) doesn’t notice anything: you borrowed 1000 shares, and returned 1000 shares, but you made money on it.

The problem is, when going long, your maximum loss is fixed (the amount your originally paid), but your potential gains are unlimited (the stock could keep rising), and it takes a lot of time to get there. Shorting, on the other hand, is really quick, but this time it’s your gains that are limited (a stock can only drop to $0 giving you 100% profit), but your losses are unlimited (the stock could go up and up, and you have to buy back those 1000 shares at a loss to return them to the broker).

Hope that helps!

Capitalism is so rational that not only can you trade things that are intangible and nonexistent materially, but you can also trade things that are intangible and nonexistent even on paper

Don’t forget you can pay to rent these intangible things for a fixed period of time.

Oh, that was actually very helpful. Thanks!

A Reddit link was detected in your comment. Here are links to the same location on alternative frontends that protect your privacy.

deleted by creator

I can see them going to $1,000 net corporate worth. Easy.