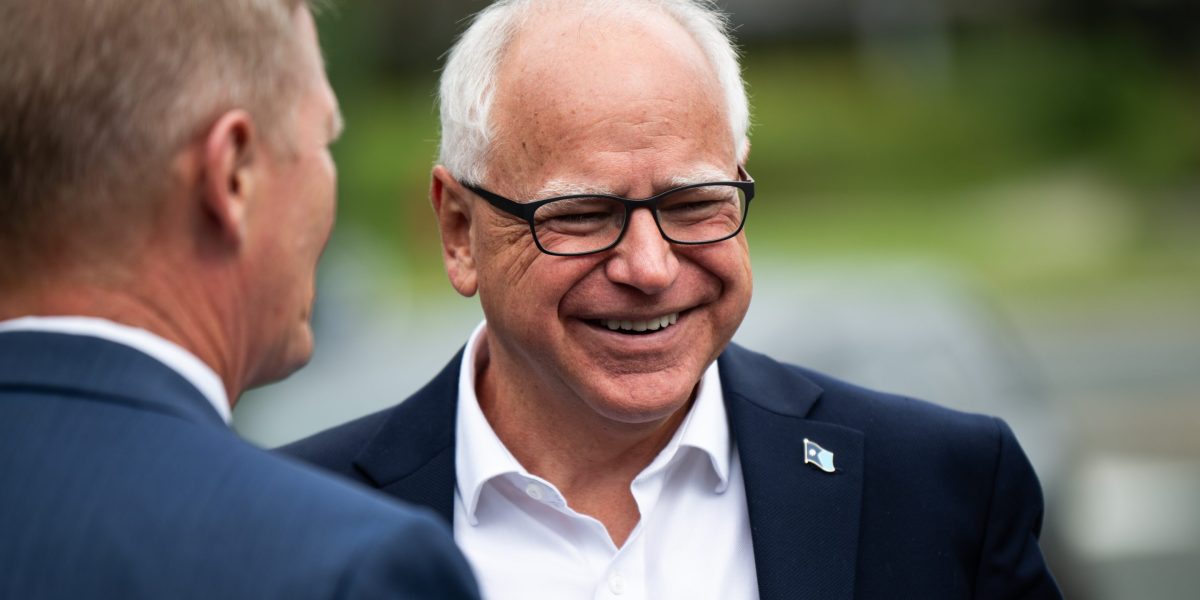

The all-American working man demeanor of Tim Walz—Kamala Harris’s new running mate—looks like it’s not just an act.

Financial disclosures show Tim Walz barely has any assets to his name. No stocks, bonds, or even property to call his own. Together with his wife, Gwen, his net worth is $330,000, according to a report by the Wall Street Journal citing financial disclosures from 2019, the year after he became Minnesota governor.

With that kind of meager nest egg, he would be more or less in line with the median figure for Americans his age (he’s 60), and even poorer than the average. One in 15 Americans is a millionaire, a recent UBS wealth report discovered.

Meanwhile, the gross annual income of Walz and his wife, Gwen, amounted to $166,719 before tax in 2022, according to their joint return filed that same year. Walz is even entitled to earn more than the $127,629 salary he receives as state governor, but he has elected not to receive the roughly $22,000 difference.

“Walz represents the stable middle class,” tax lawyer Megan Gorman, who authored a book on the personal finances of U.S. presidents, told the paper.

My point wasn’t that it makes a big difference (I actually acknowledged that in my comment).

But what was your point, if spent pension money isn’t considered a part of net income? If you’re a retired private sector CEO, you’re probably not spending your entire pension or even most of it. If you’re a retired teacher, you probably are.

My point was that leaving details out gives people an excuse to dismiss the entire point of the article. I was looking at it from the perspective of changing and winning minds. People will look for any way to resist changing their minds.

deleted by creator

Nothing is the issue. I don’t want something extra. I’m trying to gain understanding through conversation. Repeating to me that income isn’t part of net worth doesn’t help me understand. I have done some quick reading and it appears you can indeed include your pension in your net worth calculations. It isn’t necessarily just income. Seems different financial advisors handle pensions differently. Just like with a house. Some will include the value of a house in net worth, some won’t because the value of the home is not liquid.

Either way that wasn’t my original point. My original point was that the upper comment never said that including pension in net worth would turn him into a billionaire. And I was also trying to make the point that a complete picture should be provided so that some people do not simply dismiss the article entirely for one missing detail (as people will and often do use any excuse they can to change their mind).

I hope that clears my position a little. I’m not trying to argue despite what you and others might think.

deleted by creator

I guess I’m just surprised that so many people don’t view a pension as an asset and only view it as income. After the conversations here I did some reading and it looks like there’s not a consensus on whether to include a pension in net worth calculations. That being said there isn’t a consensus about including home value in net worth calculations either.

I suppose my question would be how do you define net worth? Would you agree with the other user who seems to define it as assets that can be left to survivors minus debt?

I have always thought of net worth as total assets minus total obligations/debts and would view a pension as an asset.

deleted by creator

Can you provide a source corroborating “legally it is not an asset?”

Here’s a source with case precedent that contradicts that in Massachusetts (appeals court vacated a decision to consider a pension as income): https://www.fitchlp.com/blog/2021/11/should-a-pension-be-considered-an-asset-or-a-source-of-income/

So this might be a thing that varies from State to State. And it might also depend upon the type of pension. Some pensions you can take a lump sum. It’s not always a fixed income as you stated. It sounds like you might know more than me on this subject, but I’m not finding separate resources that fully agree with you. Most sources seem to indicate it could be considered an asset or it could be considered income.