DJ Grothe on Facebook writes:

The Economist just did a big cover article on how great the U.S. economy is. Here is an unpaywalled version.

Real GDP is +8% vs. 2019, making “America…the only big economy that is back to its pre-pandemic growth trend.” This is compared to just 3% for Europe, 1% for Japan, and 0% for Britain.

Economists across the political spectrum (excepting the goofy ideological ones that feature on Fox News a lot) give most of the credit to the three big laws passed by Biden: the huge Infrastructure bill (that Trump always promised but never delivered), the Inflation Reduction Act, and the CHIPs Act, which provide incentives to build stuff in the U.S. And of course they credit Biden’s American Rescue Plan, too.

Good policy matters. Time for some skeptical debunking of the economic doomerism.

Biden is getting more done for the people than any president since FDR:

A smaller percentage of Americans are uninsured now than ever in our history.

Child poverty is at historic lows, thanks to Biden’s child tax credit in his American Rescue Plan.

Real wages are outpacing inflation for all socioeconomic quintiles.

The cost of living is actually going down (don’t believe the doomers)

America is energy independent for the first time in 40 years, and has been a net exporter of oil every year since 2020.

The cost of a gallon of gasoline nationwide on average is around three dollars a gallon, which is just a little higher than it was under Trump, and actually lower than it was under George W Bush and Obama.

Natural gas prices are at 10-year lows.

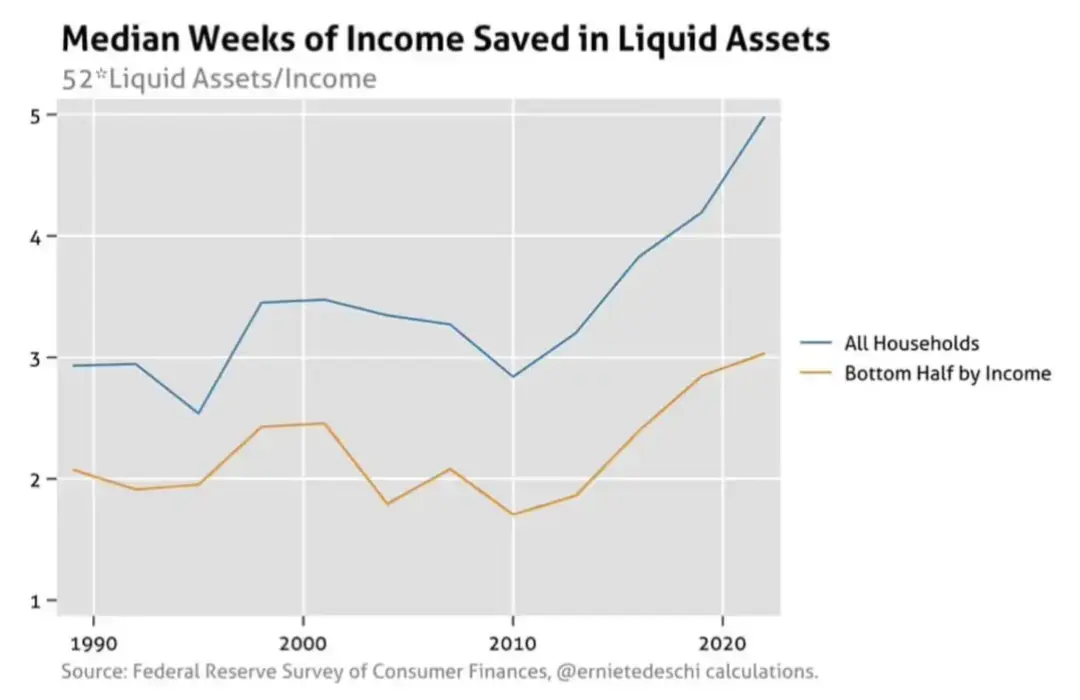

Wealth inequality under Biden is narrowing for the first time in almost 20 years…

The wealth of the lower two socioeconomic quintiles have seen their average household wealth increase by over 50% just since 2019.

The stock market is on an historic bull run.

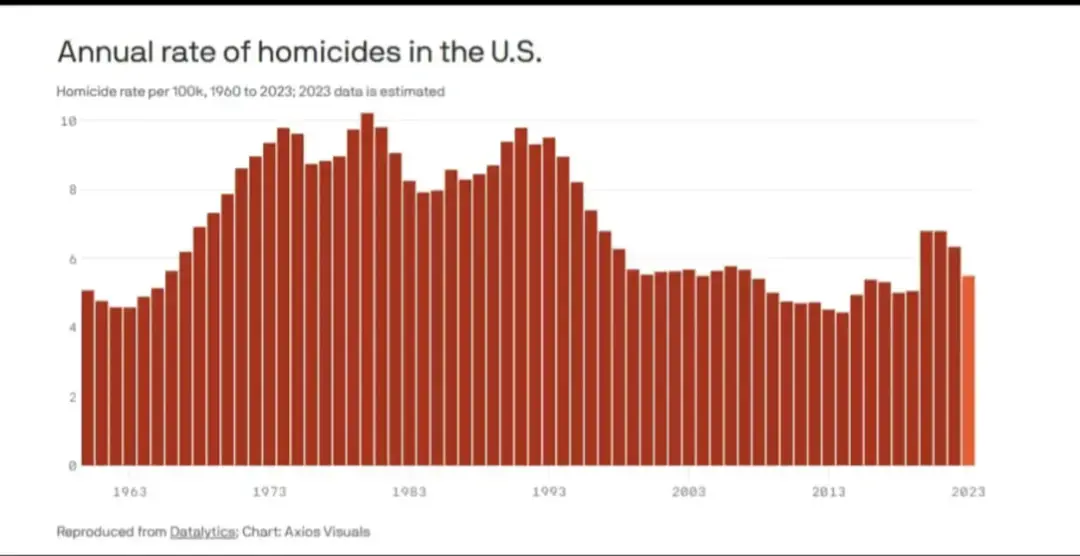

Violent crime, including the murder rate, is lower than it’s been in nearly 50 years.

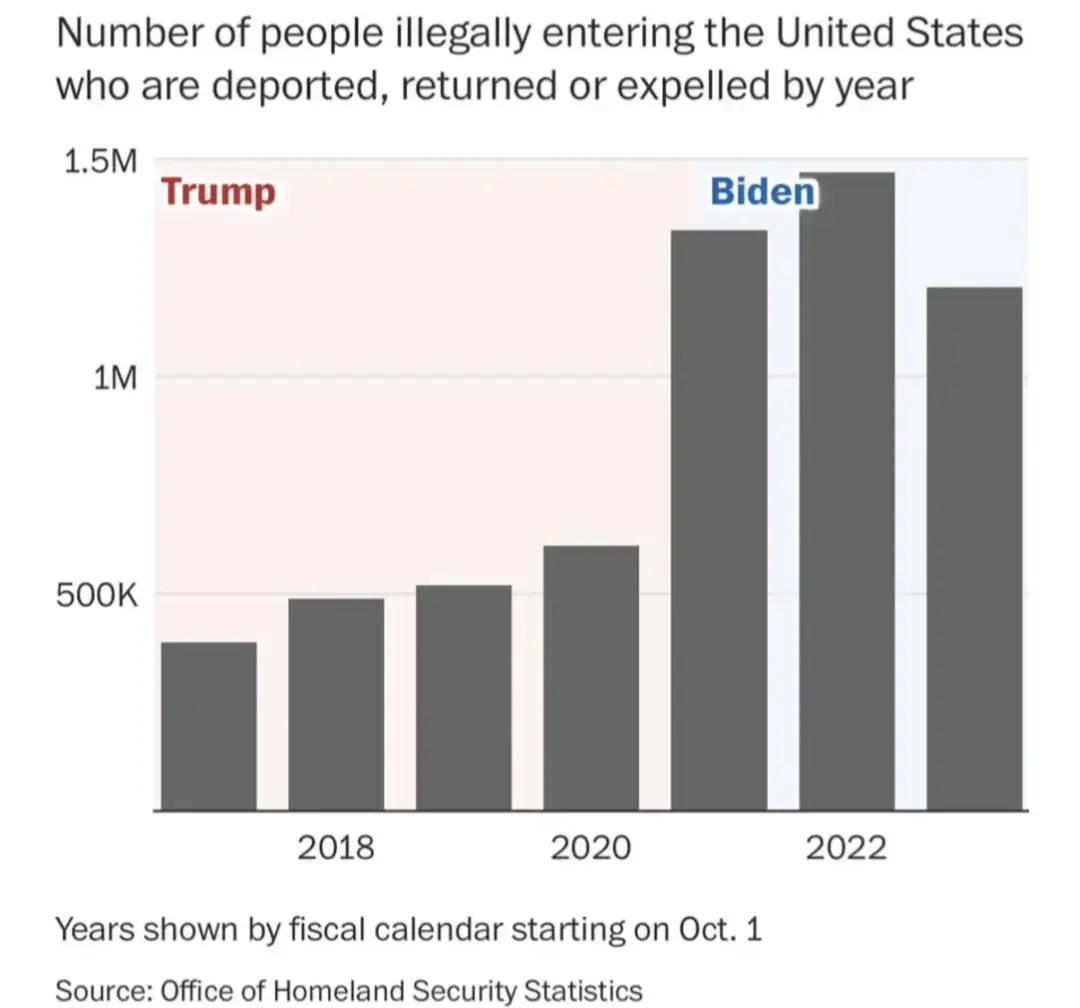

There is actually less illegal immigration under Biden than under Trump, believe it or not. (There are many more illegal border crossings now than under Trump, sadly, but there’s an order of magnitude more detentions and deportations under Biden than there were under Trump, which actually results in less illegal immigration now than under Trump.

Unemployment is at almost a 50-year low, and it’s never been lower than it is right now for Black Americans and Latinos.

Average debt-to-income ratios for American families are falling, and bankruptcies are at historic lows.

The average American household has cash savings equal to five weeks of income, which is the highest ever on record, and it’s also the record highest for the bottom half of the population by income.

Homicide rates have decreased since Trump.

Things certainly aren’t perfect, but they are much better for all socioeconomic quintiles than they were in 2019, and much better by many measures than they’ve been in many many decades.

Thanks Biden!

Ah yes, real wages are up because we ignored inflation.

That’s not what that sentence means.

People respond to prices by changing their purchase behavior. If prices go up for some things, people tend to buy less of those things, and if prices go down for some things, then people tend to buy more of those things.

Across the entire basket of stuff that people buy (measured by a weighted percentage of how people were spending their budgets the previous year), people tend to move away from the stuff that got more expensive and towards the stuff that got less expensive, so that the current household budget shifts less than the inflation measure does. It’s called the substitution effect, and the CPI intentionally pretends it doesn’t happen - so that the numbers can be more meaningful as a measure of price changes, at the cost of understating how households actually experience inflation.

https://en.wikipedia.org/wiki/Substitution_bias

Yes, I understand how people respond to increasing prices, but that sentence claims CPI is a flawed metric without saying what items are getting more expensive. For a lot of places in the US, groceries and housing are the things that are getting more expensive. It is hard to substitute those things. Unless I am missing something the article also doesn’t mention what it uses as a deflator.

The math behind what I’m saying means that the phenomenon naturally happens regardless of which items move up or down, and even if all items move up (so long as they move up at different rates).

Eggs in February 2024 are down about 29% for the year from February 2023, down from the very high January 2023 spike. Ground beef is up about 7.4% for the year. Chicken breast is down 6%.

So a typical household that does eat animal products would likely have shifted away from beef towards chicken in the past year, even as the index weights them the same as they did before, month to month. That’s the kind of thing that doesn’t get captured until the relative weights index is updated.

Right, I get that. My point is that, at least in my area, all groceries are still up and rents are not going down. Overall expenses are still up, so the CPI translates well. I’m not saying things are not getting better, but IMO the article is cherry picking the best results and it doesn’t reflect most people’s reality.

My point is that groceries aren’t up equally, and groceries don’t all cost the same. Someone on a subsistence diet of lentils and rice might not have much room to adjust their food spending in response to prices, but the broader shifts of beef to pork, pork to chicken, chicken to eggs, meat to beans, reduction in sodas/chips/candy, etc., give a typical household some room to maneuver.

Put another way, if you ask people whether their grocery purchasing behavior has been affected by rising prices, most people will say yes. That behavioral shift is how we respond to price increases, to try to blunt the effects of a price increase.

(Arguing against the point of my own post) if people are substituting to “inferior” products then that indicates hardship and the CPI correctly measures that.

It is like if people started showering only once a week because hot water is too expensive. We should still be counting how much it costs to shower every day, not fudging the measurements to accomodate coping strategies.

I agree with that, as a measure of price changes over time. I think the CPI correctly ignores substitution bias month to month, so that we can get a better picture of the price changes.

In terms of household effects, though, the substitution effect tends to slightly reduce the effect of high prices on household budgets, and that’s what I understood as the meaning of that particular sentence at the top of this comment chain.

And I don’t think of these particular examples of inferior or superior goods. The relative cost of chicken, pork, ground beef, certain cuts of steak, lamb, lobster, etc. is different from place to place, and not necessarily a reflection of consumer preference in all places.

I don’t know how many times I can say I understand what you are saying, but it is not the case in my area. Most groceries are up, at least in my city. Overall grocery bills are still very high, even accounting for buying cheaper alternatives. Combine that with ever climbing rent and it is not nearly as rosey as the article claims. Again, I am not saying things aren’t slowly coming down, just that it is not as good as the article claims.

I’m specifically saying that even if groceries (or rent) are up by a lot, the math of what I’m describing still works out. So when you say “this is not the case in my area,” you’re effectively saying that you’ve made zero changes in how you shop for groceries, in response to the price increases. I think that’s probably not true for you in particular, and almost certainly not true for people in your area. Most people respond to prices with changed behavior.

https://www.washingtonpost.com/business/2024/02/02/grocery-price-inflation-biden/

https://time.com/6250895/grocery-prices-rising-inflation/

https://www.forbes.com/sites/errolschweizer/2024/02/07/why-your-groceries-are-still-so-expensive/?sh=2e30851d6ba8

https://www.wsj.com/economy/consumers/grocery-prices-inflation-coffee-milk-903aead6

That was a great simple explanation, thank you. I’ve certainly made some adjustments, and was thinking about it yesterday while shopping. Paper supplies have gotten so very expensive that I’ve (finally) purchased cloth napkins to use both for napkins and for smaller kitchen clean up jobs. I’ll be using less paper, and more water for laundry. I’m estimating 1-2 loads worth of napkins per month. Pretty sure it will be both cheaper and more environmentally friendly than paper towels.