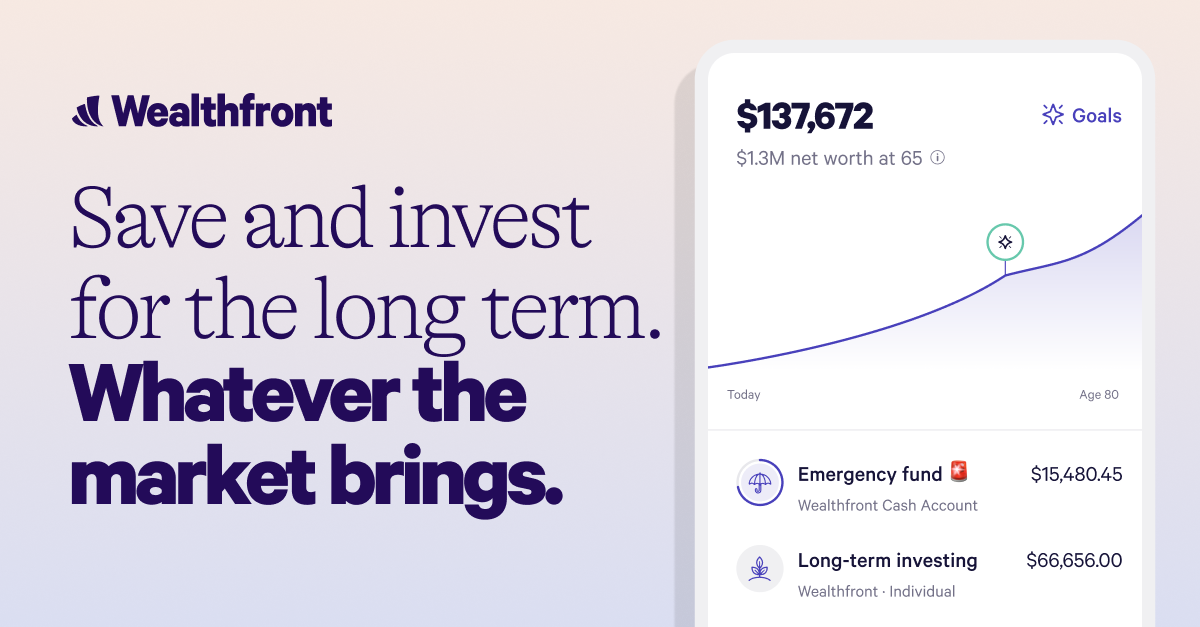

A buddy of mine told me about Wealthfront recently and they’re 5% money market account rates.

Growing up in a world where savings accounts and even CDs never approached more than 2%, the rates on this new thing blew me away.

Free money is great, and I’d love to take advantage of these rates, but the only cash I have currently is the emergency fund I’m trying to build.

Anyone have thoughts on if putting an efund in this kind of service is a bad idea? Not sure if it’ll be liquid enough if a major expense comes up.

I don’t know this particular place, but I have my emergency fund in a vanguard money market (Vusxx), and it is super safe and returning over 5%. It takes about 24hrs to settle any sells, so I have fairly quick access to my cash

Money market is the way to go. You are exposed directly to the federal bonds, which are basically what most banks use to back their high interest accounts, so you will get the the highest rate possible with no middle man. Money market funds are not FDIC insured, but the Vanguard fund (VMFXX) has never “broken the buck” or lost value since its inception in 1981.

I put my entire emergency fund in wealthfront. It was just sitting in a savings making nothing otherwise.

I really like Wealthfront’s automated savings, and their website is top notch. Very easy to use and navigate.

I’ve been using it for a year now and already signed up 3 people. Been nabbing that extra % when I can.

I have my savings in a high yield savings account (FDIC insured) and a checking account at the same bank, so I can access the money pretty much instantly if needed. I don’t use Wealthfront specifically but I’ve heard good things about them. Once you earn more than $10 in interest you do have to pay taxes on it.

It’s just a bank account at the end of the day, and it’s FDIC-insured, so why not?

I’m using SoFi right now (4.5%), but I’d switch to Wealthfront in a heartbeat if they had joint account support. They’re always very fast to raise the rate when the fed announces a rate hike, and they seem generally pleasant to use from what my coworkers say.

SoFi has 4.50% Apy on a checking/savings account. Not too shabby for FDIC insured.

Removed by mod